TARIC, standing for Integrated Tariff of the European Communities (or more specifically – TARiff Integre Communautaire), is a multilingual database containing the various rules which apply to the import of specific products imported into the EU. These rules cover all the measures relating to tariff, commercial and agricultural import legislation. The purpose of the TARIC system is to ensure the uniform application of import measures by all EU Member States. It is also a great resource for local exporters (and intermediaries such as freight forwarders, etc.) of products to the EU to learn what tariffs and other import rules apply to their products. The TARIC system also makes available community-wide statistics for the measures concerned, but does not contain information relating to national levies such as rates of VAT and rates of excise duties.

A break-down of the TARIC system

The TARIC contains the following main categories of measures:

- Tariff measures:

- Third country duty rates, as defined in the Combined Nomenclature

- Suspensions of duties;

- Tariff quotas; and

- Tariff preferences.

- Agricultural measures:

- Agricultural components;

- Additional duties on sugar and flour contents;

- Countervailing charges; and

- Refunds for export of basic (i.e. non processed) agricultural goods.

- Commercial measures:

- Antidumping measures; and

- Countervailing duties measure.

- Measures relating to restriction of movements:

- Import and export prohibitions;

- Import and export restrictions; and

- Quantitative limits

- Measures for gathering of statistical data:

- Import surveillances;

- Export surveillance

The TARIC codes

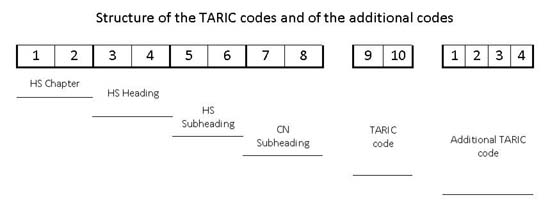

Understanding the TARIC system is also important from the point-of-view of the tariff codes used within the system. The TARIC system uses a 10-digit TARIC code which builds upon the international harmonised system and the combined nomenclature, but which incorporates a unique 2-digit TARIC component as well (in some instances, a further four digits may be included in the code for more exact differentiations between products) . In trade with third countries, the TARIC code must be used in customs and statistical declarations – see the figure below.

Source: http://en.wikipedia.org/wiki/Image:TARIC_code_structure.JPG

The table below provides an explanation of the 10-digit TARIC code:

|

HS Chapter

|

2 digits |

E.g. 18 – Cocoa and Cocoa Preparations |

|

HS Heading |

2 digits |

E.g. 1806 – Chocolate and other food preparations containing cocoa |

|

HS SubHeading |

2 digits |

E.g. 1806 10 – Cocoa powder, containing added sugar or other sweetening matter |

|

CN SubHeading |

2 digits |

E.g. 1806 10 15 – Containing no sucrose or containing less than 5% by weight of sucrose (including invert sugar expressed as sucrose) or isoglucose expressed as sucrose |

|

TARIC Sub Heading |

2 digits |

E.g. 1806 10 15 00 |

This above information was adapted from the European Commission’s Taxation and Customs Union and Wikipedia websites.

Additional links:

Additional TARIC links:

- Search the TARIC database – An online search facility hosted on the EU website

- How to use TARIC – Useful information on how to use the TARIC codes, provided by the Foreign Agricultural Service, US Mission to the EU.

- More information on TARIC provided by HM Revenue and Customs

- TARIC reference document

- TARIC Query System Online – a PDF document providing background information on the TARIC system made available by Swedish Customs

- EU Taxation and Customs Union

- More information on the TARIC system – provided by Business Link in the UK

Other EU-related information

- EU website

- VAT rates – European Union

- News from member states

- Guide to Exporting to the EU – provided by CBI in the Netherlands

- Guide to doing business with the EU – Provided by the Hong Kong Trade Development Council

- Manufacturers face new challenges exporting to the EU – Provided by JP Morgan

- A methodology for exporting to the EU – provided by the Jordan-EU Association